personal property tax car richmond va

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web The following ownership and use qualify for personal property tax exemption.

1401 Chauncey Ln Richmond Va 23238 Realtor Com

If your vehicle is valued at 18030 the total tax would be 667.

. Web Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in. WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. Web The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled.

Web Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Web An example provided by the City of Richmond goes like this. If you can answer YES to any of the following questions your vehicle is.

Unsure Of The Value Of Your Property. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online. The vehicle is used primarily by or for the disabled.

Web In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. At the calculated PPTRA rate of 30 you. Tax rates differ depending.

The vehicle is owned by the disabled veteran. Web The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231. Web Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Web RICHMOND Va. Web And if you need to register your car youll likely get a letter from DMV saying you cant register or re-register until you have paid the personal property taxes. Electronic Check ACHEFT 095.

Ad Find Richmond County Online Property Taxes Info From 2022. My office has used the same. Find All The Record Information You Need Here.

Web Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD. Web Personal property tax applies to any vehicle normally garaged or parked in Prince William County - even if the vehicle is registered in another state or county. Web Parking Violations Online Payment.

Real Estate and Personal Property Taxes Online Payment.

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BRBUNT5HJEV3FAU4MARGFN4PY.jpg)

New Law Means Lower Vehicle Registration Fees In Virginia But Added Highway Use Fee

8301 Whistler Rd Richmond Va 23227 Realtor Com

11408 Brendonridge Ln Richmond Va 23238 Realtor Com

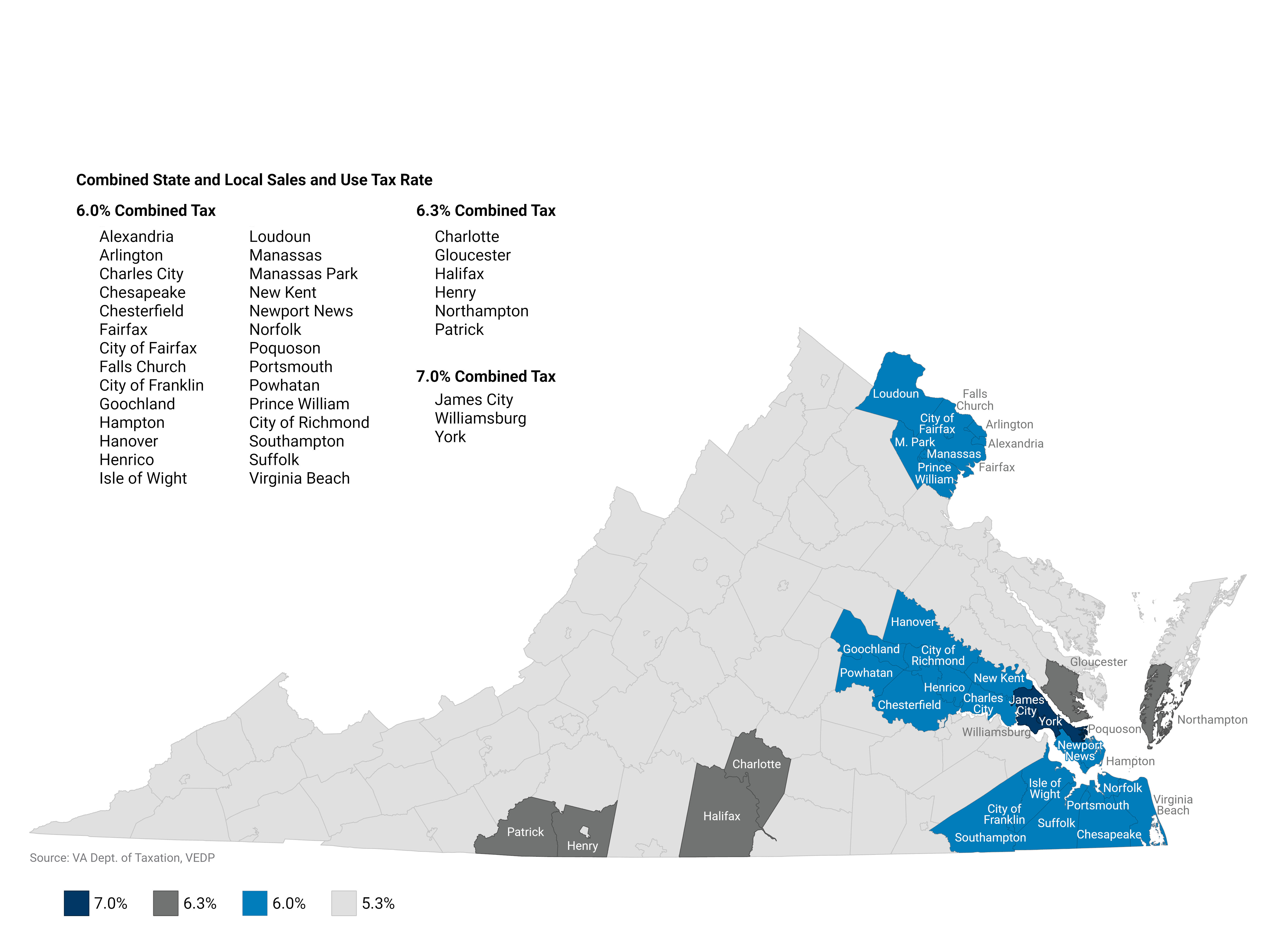

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BRBUNT5HJEV3FAU4MARGFN4PY.jpg)

New Law Means Lower Vehicle Registration Fees In Virginia But Added Highway Use Fee

Pay Online Chesterfield County Va

601 Roseneath Rd Unit U1 Richmond Va 23221 Realtor Com

2309 W Grace St Richmond Va 23220 Realtor Com

Why Does Virginia Have A Car Tax Wtop News

12702 Kira Ct Richmond Va 23233 Realtor Com

10218 Salem Oaks Dr Richmond Va 23237 Realtor Com

Pay Online Chesterfield County Va

1401 Chauncey Ln Richmond Va 23238 Realtor Com

2416 Mountainbrook Dr Richmond Va 23233 Realtor Com

Fishing Boats Taxed 30 Times Higher Than Houseboats In Ky Lexington Herald Leader